Is Drop Shipping Legal in the UK – Running a Profitable Ecommerce Business

Yes drop shipping is legal in the UK as long as you abide by trading rules, follow GDPR guidelines, and pay the necessary taxes. Drop shipping allows entrepreneurs desiring to open an online store to sell products without maintaining inventory, therefore reducing overhead costs and increasing profit margins. Dropshipping is essentially the way you, utilising Amazon to effectuate these transactions, operate as a middleman between the supplier and the client. Still, you should be aware of various legal issues to make sure your company operates free from incident and legally. Key topics include UK taxes, GDPR compliance, selecting reputable suppliers, and sales tax administration for foreign clients will be covered in this session.

Drop cargo is what Dropshipping is a quite popular business model nowadays. Still, especially in the UK, business owners should be aware of their legal responsibilities connected with this conduct.

From VAT obligations to order fulfilment and delivery, are essential elements of financial compliance for dropshipping companies, therefore affecting both stores and their profit. All of which are vital for running a profitable and profit-generating dropshipping store in GDPR compliance, this paper examines the main legal issues for Dropshipping Businesses in the UK, including e-commerce retailer responsibilities, online e-commerce website regulations, Shopify platform specifics, affiliate marketing strategies, delivery and order fulfilment requirements.

Entrepreneurs—including online sellers and drop shippers engaged in retail arbitrage using the dropshipping model—can protect their e-commerce website businesses on platforms like Shopify and give consumers a safe and trustworthy shopping experience especially when handling consumer orders and store products. This covers running your dropship business and effective cost control of shipments.

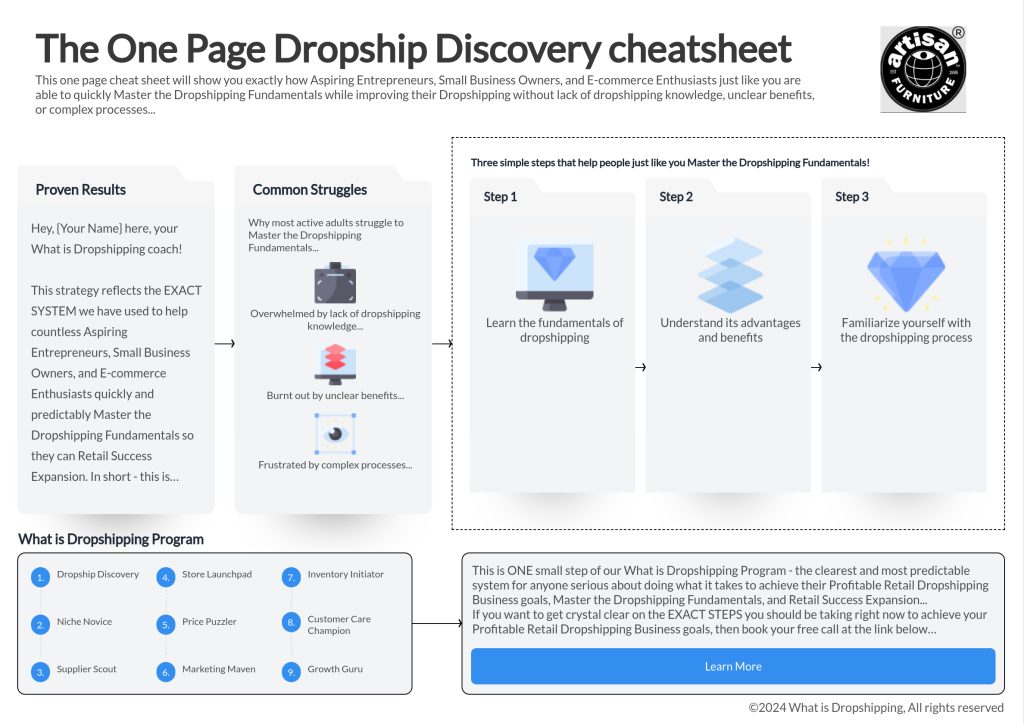

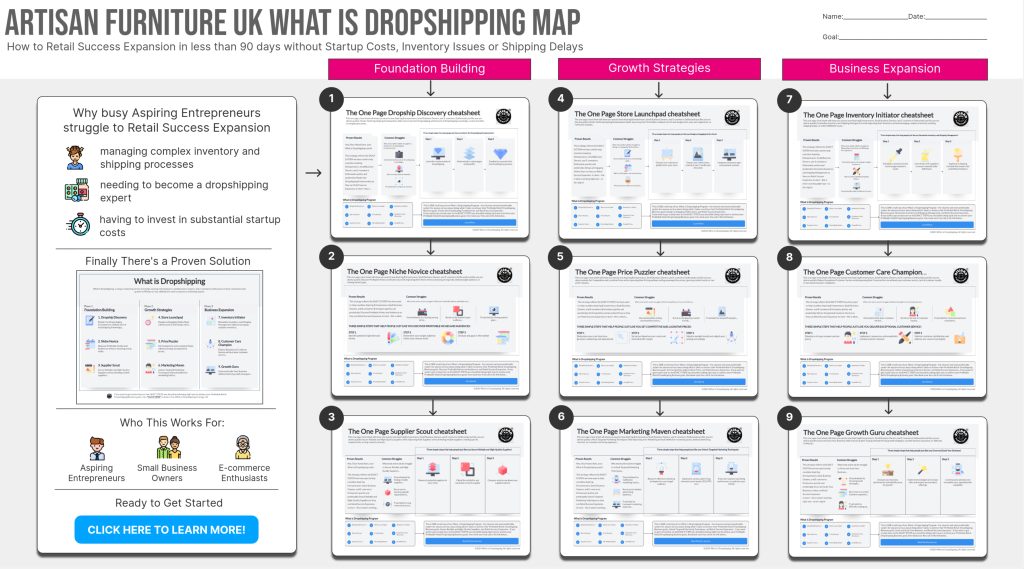

Dropship basics

-

Often allowed by e-commerce sites like Shopify to sell goods online for order fulfilment and delivery, dropshipping companies in the UK must follow consumer protection laws, intellectual property rights, and data protection rules when picking products to provide.

-

Retailers of e-commerce enterprises selling goods online and dropshipped orders from outside the UK to consumers within the UK, including those using Shopify for order fulfilment and delivery as part of their fulfilment process, may find VAT registration required.

-

Online e-commerce and dropshipping companies—including teaching consumers data collecting, implementing security measures, and evaluating Shopify order fulfilment process and marketing activities—need GDPR compliance—conforming with inventory and seller rules.

-

Apart from guaranteeing a strong dropshipping agreement for their e-commerce activities, dropshippers—including Shopify sellers—have to secure the required business licenses and follow consumer protection standards including accurate product descriptions and clear return policies.

Understanding drop shipping in the UK

Analysing the many operational models, including Shopify fulfilment, will assist one to totally grasp the subtleties of dropshipping in the UK as an e-commerce company by matching the legal framework and marketing strategies as a seller.

Driven mostly by platforms like Shopify, dropshipping is an e-commerce business model whereby a seller, acting as a store, depends on fulfilment by third parties rather than maintaining stock of the items they offer, hence much supported by marketing. Under a dropshipping arrangement contract, drop shippers at the e-commerce company instead pass customer orders and shipment details to numerous suppliers, who then personally deliver the goods via platforms like Shopify.

Dropshipping for an e-commerce company presents three key operational models using Shopify as a platform: arbitrage, private label, and manufacturing integrating seller engagement and fulfilment methods.

Frequused in e-commerce and dropshipping, arbitrage—the process of finding items at a cheap price from one supplier—then selling them to consumers on sites like Shopify, so acting as the seller to create profit.

Often an e-commerce business running Shopify, private label is the process by which a retailer—sometimes via dropshipping—buys things from a supplier, then brands them as their own.

Given stores create their own products, manufacturing is the most complicated.

Legally, dropshipping in the UK has to follow many criteria including consumer protection rules, intellectual property rights, and data privacy.

Particularly with reference to shipping information across the dropship process, stores—including drop shippers who market your dropshipping and sell goods online using the dropshipping model—must provide accurate product descriptions, offer refunds or exchanges, and guarantee that customer data is handled securely.

They also have to honour intellectual property rights by not violating copyrights or trademarks.

VAT Requirements for Drop shipping businesses

Retailers utilising Shopify for dropship activities have to carefully assess the VAT liabilities and assure fulfilling compliance to avert any possible legal penalties. Value Added Tax (VAT) Whether they are the supplier or the dropshipper involved in dropshipping and fulfilment, the retailer has the task of precisely charging and tracking VAT on their sales applied as a consumption tax on goods and services inside the European Union (EU).

Regarding dropshipping, stores should be especially cautious of specialised VAT regulations. Should a retailer dropship items from outside the UK to consumers within the UK, they could have to register for VAT in the UK. This is so because the retailer, operating under a dropshipping fulfilment arrangement, is in charge of VAT accounting and charging and is judged to be delivering the items to the client.

However, if the shop dropship goods from within the UK to customers outside since they are not considered as the provider, they might not have to register for VAT. In this case, the dropshipper handling dropshipping and fulfilment charges VAT and handles accounting.

Retailers involved in fulfilling and dropshipping also have to ensure they have the correct records and documentation proving they meet VAT regulations. This comprises maintaining exact records of sales, invoicing, VAT returns, fulfilment, and dropshipping for a retail business.

GDPR Compliance for dropshipping in the UK

Dropshipping businesses in the UK have many crucial steps to ensure GDPR compliance in handling customer data, therefore maintaining consumer faith of the online store. For e-commerce stores most especially, the General Data Protection Regulation (GDPR) is a collection of guidelines controlling the collecting, storing, and processing of personal data for European Union members. For dropshipping businesses, this means they have to adhere to particular guidelines to protect client personal information.

First priority is clearly informing clients of the data collection process and how it will be applied. This content should be easily reachable on the dropship website under a privacy policy. Before compiling their data, companies also need specific client approval.

Moreover, dropshipping businesses have to provide customer data security by using appropriate organisational and technological solutions. This addresses routinely updating security systems, restricting access to personal data, and encrypting data for protection during storage and transmission.

The primary activities required for GDPR compliance in dropshipping businesses are collected in this table.

| Key Steps for GDPR Compliance in Dropshipping Businesses |

|---|

| Clearly inform customers about data collection and usage |

| Obtain explicit consent from customers |

| Implement appropriate security measures for data protection |

| Regularly update security systems |

| Restrict access to personal data |

Legal Obligations for Dropshipping entrepreneurs

If owners of dropshipping companies wish to run their companies ethically and escape possible legal consequences, they need be aware of their legal responsibilities, which include following consumer protection laws. Dropshippers should be aware of their legal obligations relevant to their dropshipping company model since noncompliance could lead to fines, legal action, and reputation harm.

Four essential legal obligations should be familiar to dropship firm owners:

- Though they are not customers, dropshippers have to abide by consumer protection rules varying by jurisdiction. Usually, these guidelines call for businesses to fulfil warranties, provide accurate product descriptions, quickly respond to consumer complaints, ensure timely shipping and drop-off practices.

- Intellectual Property Rights: Dropshippers have to be careful to source products for their operations not breaking any copyrights, trademarks, or patents. Dependent on this is maintaining the legal integrity of their online store, which includes dropship provider Amazon and AliExpress as well as shipping. This entails painstakingly ensuring that the products they are dropshipping through never violate any intellectual property rights.

- Dropshipped by nature, dropshippers have to abide by European Union data privacy guidelines including the General Data privacy Regulatory (GDPR). This addresses obtaining the required consent for accumulating and using customer data, implementing appropriate security standards, and providing consumers access to their own records.

- Along with advertising guidelines, dropshippers have to abide by moral standards in advertising and avoidance of dishonest marketing practices. This covers providing accurate product information, avoiding false claims, and exposing any sponsored material or affiliate relationships.

Business Licensing Requirements for dropshipping in the UK

To be legally running their dropshipping businesses, UK business owners must ensure they meet the necessary licencing standards. Dropshipping, a low-cost business idea allowing businesses to sell items without maintaining inventory, has grown rather popular. Though, business owners have to understand and abide by the legal obligations related with the dropshipping company model if they are to ensure the success of their online store.

One of the primary licensing requirements for dropshipping in the UK is current business licence necessity. Any business wanting to legally operate inside the country needs this licence. It ensures that the business meets government set criteria and standards and is registered. Moreover, depending on the type of products they sell, dropshipping businesses could also have to have specific licenses or permits. Extra permissions could be required, for example, if a corporation dropships weapons or drugs requiring particular permits or certificates.

Drop-shipping companies also fall under consumer protection rules including the Consumer Rights Act 2015. This includes making sure items meet their intended function and are of acceptable quality as stated. Furthermore clear to consumers about their terms and conditions, refund policies, and company identification are dropshipping firm owners must be.

Ensuring Consumer protection in dropshipping

Business owners who wish consumer protection in dropshipping have to give top priority strong standards and practices that guarantee customer satisfaction and respect of consumer rights first importance. This helps one establish a legitimate dropship firm and get consumer confidence.

Four major processes should be followed by business owners to ensure consumer safety including shipping and dropshipping process, advantages of dropshipping, and best dropshipping suppliers.

- Accurate and detailed product descriptions containing information on quality, dimensions, materials, source products, and shipping assist consumers make intelligent purchasing selections and reduces the chance of conflicts and decreased satisfaction.

- Keeping customer happiness depends on products supplied quickly and ensuring dependability of shipping techniques—including dropshipping. Consumers should be given tracking numbers so they may keep an eye on the changes in their dropshipping orders.

- Maintaining customer satisfaction requires quick response of consumer queries and complaints as well as effective lines of contact. Particularly with regard to shipping and make-dropship issues, customers should be helped all through the purchasing process by a dedicated customer service team.

- Clear, fair return and refund policies protect consumer rights and provide consumers hope that, should they be unhappy, they can either return or swap goods including shipping and drop-off possibilities. Consumer rights legislation should be rigorously followed by these guidelines and given to dropship store customers specifically.

Tax Considerations for Dropshipping businesses in the UK

Published new tax rules by the UK government urge dropshipping companies to take into account while conducting operations here. These rules try to guarantee accurate registration and fair tax payment by dropshipping companies. Ignorance of these rules could cause fines and legal action.

One of the primary tax concerns for UK dropshipping businesses have to deal with is the Value Added Tax (VAT) registration requirements. Should a dropship company exceed the £85,000 annual VAT limit, it must register for VAT and charge the appropriate VAT rate on its sales. The business will thus have to compile VAT from consumers, note VAT on its invoices, and transmit regular VAT reports to HM Revenue & Customs.

Apart from VAT, dropshipping businesses have to consider several taxes including income tax and corporation tax. Income tax is relevant whether the firm is conducted as a sole trader or a partnership; corporation tax is relevant if the company is registered as a limited company.

This table provides a synopsis of the main tax laws and requirements to enable one to better understand the tax concerns for UK drop-shipping businesses:

| Tax Consideration | Description | Deadline |

|---|---|---|

| VAT Registration | Register for VAT if annual turnover exceeds £85,000 | Within 30 days of exceeding threshold |

| VAT Returns | Submit regular VAT returns to HMRC | Quarterly |

| Income Tax | Pay income tax on business profits | Annually by 31 January |

| Corporation Tax | Pay corporation tax on business profits | Annually within 9 months of accounting period end |

It is important for dropshipping businesses to seek professional advice and ensure compliance with these tax regulations to avoid any legal issues and penalties.

Drop shipping profit margins: Analysis & Impact

Understanding dropshipping profit margins is key to unlocking the potential of your online business, making it a crucial step for any aspiring entrepreneur aiming for success.

Is Dropshipping profitable – A Look at the Risks and Rewards

For would-be business owners especially considering minimal initial costs, dropshipping might be a seductive business concept. Dropshipping removes the requirement for upfront inventory control and storage space investment unlike traditional retail. Faster potential profitability follows from this than from physical stores.

Profit margins in dropshipping can be really small, nevertheless. The wholesale supplier—who supplies the good—gets a good share of the income. Additionally considered by dropshippers are extra running expenses including:

- Online markets or E-commerce systems costs

- Costs related to marketing and advertising

- Costs of shipping and logistics

- Customer service costs—managing questions and returns—

If not well controlled, these running expenses can rapidly eat into earnings.

Here we break out some key factors affecting dropshipping profitability:

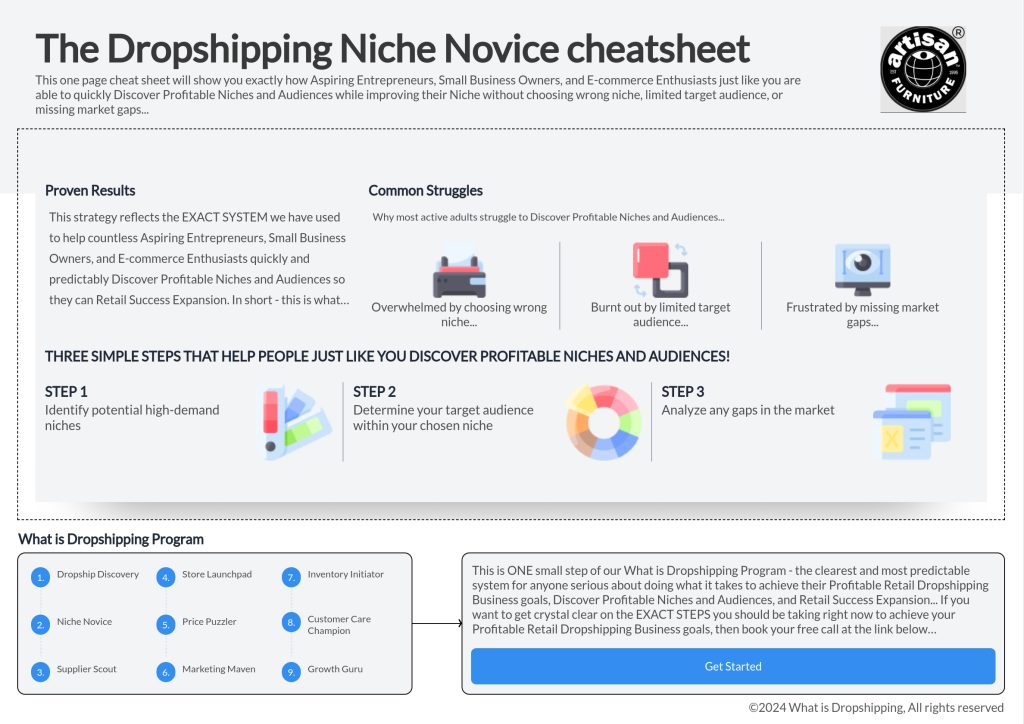

- Choosing highly sought-after, fairly priced products inside a well-researched niche market with less competition will significantly increase revenue potential.

- Profitability depends on developing a reasonable pricing strategy considering target consumer willingness to pay, market competitiveness, and supplier costs.

- Advertising & Marketing: Most importantly are effective marketing campaigns that drive traffic to your web business and generate revenue. These initiatives do, however, cost money that has to be included into your calculations of profit margin.

- Working with trustworthy wholesale suppliers that offer competitive pricing, excellent products, and fast shipping and logistical services determines both a flawless business and positive client experience.

Dropshipping require first priority in risk management. Before opening your store, you really should do market study and competition analysis. Long-term success depends on one knowing the competitive environment and the hazards connected with return policies, tax concerns, and customer service problems.

Dropshipping is not the path to wealth exactly. Success calls both precision planning and smart execution in addition to a customer-centric viewpoint. Stressing branding, good marketing, first-rate customer service, and strong supplier relationships will help dropshippers expand their chances of success and create a sustainable online business.

Frequently Asked Questions

Does my dropship company need to register in the UK?

Yes, you must register your Drop Shipping company in the UK. Should you operate as a sole trader, you have to register with HM Revenue and Customs (HMRC). Should you establish a limited company or a partnership, you must register with Companies House.

For a dropship company registered in the UK, what tax responsibilities do I have?

Yes, dropshipping companies operating in the UK have tax responsibilities including income tax, National Insurance contributions should you be a single trader or a partner, and corporation tax should you be running as a limited company. Should your taxable turnover be more than the VAT threshold, you might also have to register for VAT.

Does the UK have any particular consumer rights legislation that impact dropshipping?

Yes, dropshipping companies operating in the UK have to abide by consumer rights legislation, which include the Consumer Rights Act 2015 covering the quality, fitness, and description of products provided and the Consumer Contracts Regulations, thereby granting rights to consumers purchasing online.

Does my drop-shipping company have to follow GDPR?

Yes, you have to follow the General Data Protection Regulation (GDPR) and the UK Data Protection Act 2018 whether your dropship company handles personal data of people living in the UK or the EU. This covers getting permission for data processing, guaranteeing data security, and granting people rights about their personal data.

How can I make sure my dropshipped goods satisfy UK safety requirements?

Yes, you have to make sure the goods you offer satisfy UK safety criteria. This entails making sure your goods follow particular rules pertinent to their category—e.g., electronics, toys, cosmetics—and keeping documentation proving compliance, such CE marks or UKCA marks.

Exist import taxes and fees for dropship to the UK?

Yes, import taxes and charges could apply if you are bringing products into the UK to meet requests. The kind of commodities and their value define the rates and applicability. Knowing these responsibilities helps one to tell clients about possible extra expenses.

Does my dropshipping business in the UK require insurance?

Yes, insurance for your dropshipping company in the UK is rather desirable even though it is not a legal need. To guard your company from lawsuits and legal expenses, think about plans including professional indemnity insurance and product liability insurance.

In dropship, how do I lawfully handle returns and refunds?

Yes, in the UK you have to follow the Consumer Contracts Regulations, which provide consumers the opportunity to cancel online transactions within fourteen days of acquiring the items. You must guarantee you handle returns and refunds in line with the law and present clear information on them.

What is drop shipping?

Drop shipping is a retail fulfilment method whereby a store does not keep the things it sells in inventory. Instead, a store purchases a good from a third-party vendor and gets it delivered straight to the customer when it sells it. The trader thereby never sees or handles the good.

Drop shipping vs ecommerce

Although they pertain to different business strategies, drop shipping and e-commerce are sometimes used synonymically. The main distinction is inventory control even if both entail online product sales. Under a conventional e-commerce strategy, companies buy goods ahead of time and keep them until a transaction is made, therefore tying off funds. Conversely, the dropshipping strategy minimises inventory costs and risks by letting you only buy goods from vendors following a sale. Usually freeing the hassle of inventory control from larger profit margins, this allows dropshippers to focus on marketing and customer experience.

How does dropshipping affect a business reputation?

Actually, the dependability of its suppliers and quality of items identify a dropship company most of all. Since the merchant has no direct influence over inventory or shipment, any issues with product delays, quality, or fulfilment will impact their reputation.

Can I use multiple suppliers for my dropshipping business?

Yes, depending on different vendors helps you to show more diversity of products and provides defence against possible supply chain disruptions. Managing several supplier connections, meanwhile, might significantly complicate your order processing system.

How do I ensure product quality when dropshipping?

Before working with any supplier in dropshipping, do extensive investigation to guarantee product quality. Read supplier evaluations, have open contact with your quality criteria, and order samples for yourself to personally verify quality. Review client comments often to get understanding of possible quality problems.

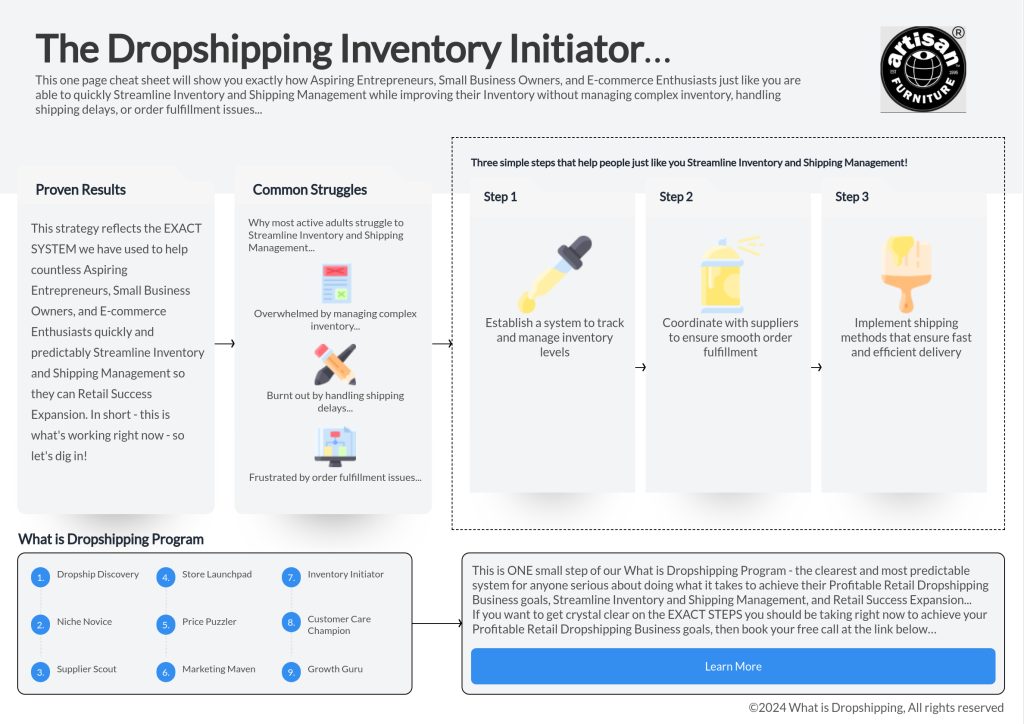

What are some common challenges with dropshipping regarding supply chain management?

Since inventory is not directly under control by the retailer, there are some common challenges including handling out-of-stock items; longer shipping times compared to stocking inventory; limited control over packaging and branding; difficulties in ensuring consistent product quality; and possible communication barriers between retailers, suppliers, and consumers that could lead to order fulfilment mistakes.

Images

Drop shipping process